10 Easy Facts About Estate Planning Attorney Shown

10 Easy Facts About Estate Planning Attorney Shown

Blog Article

Our Estate Planning Attorney PDFs

Table of ContentsWhat Does Estate Planning Attorney Do?The smart Trick of Estate Planning Attorney That Nobody is Talking AboutEstate Planning Attorney - QuestionsFascination About Estate Planning Attorney

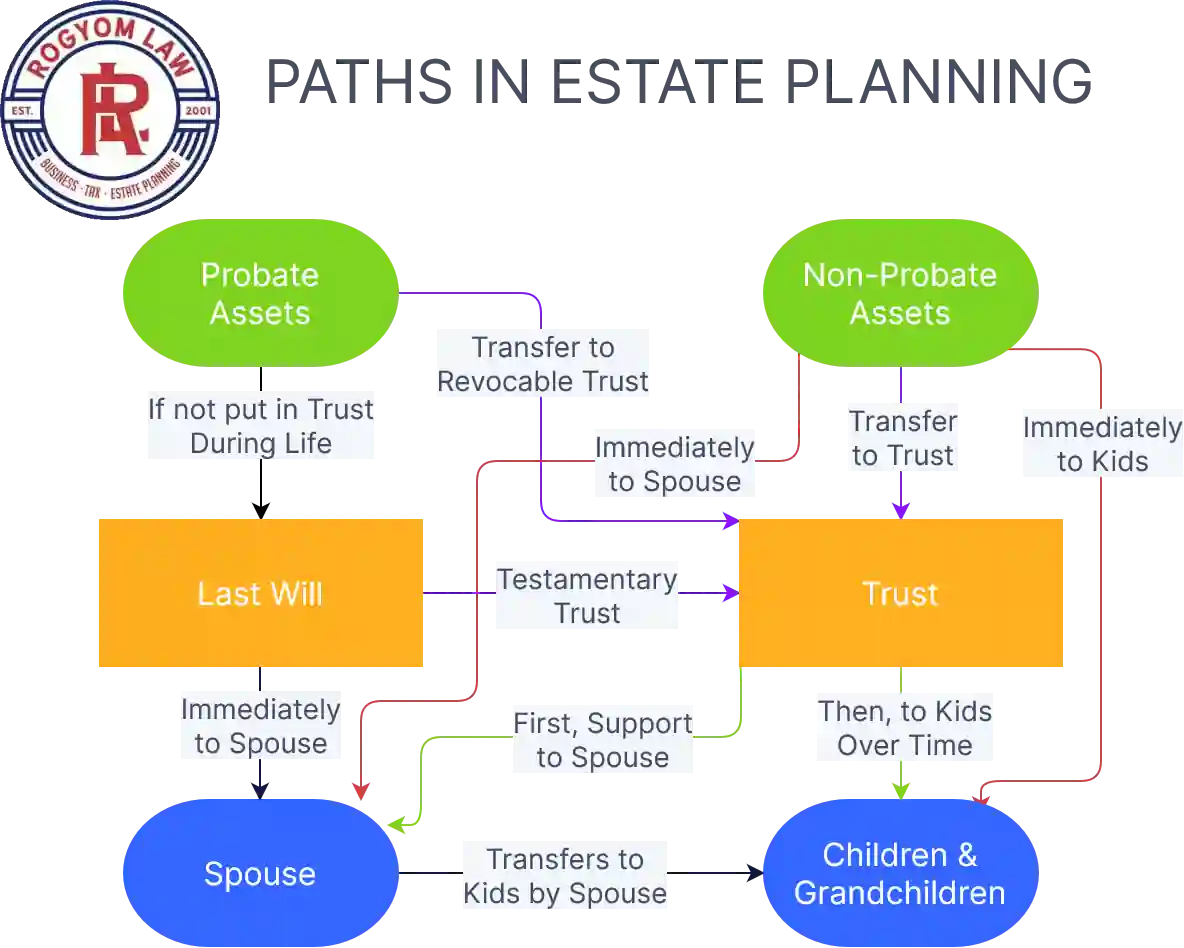

Estate planning is an activity strategy you can use to determine what occurs to your possessions and obligations while you live and after you die. A will, on the various other hand, is a lawful file that describes exactly how assets are distributed, that takes care of youngsters and pets, and any type of various other dreams after you pass away.

The executor also has to repay any kind of tax obligations and financial obligation owed by the deceased from the estate. Lenders generally have a limited amount of time from the day they were notified of the testator's death to make claims against the estate for money owed to them. Claims that are rejected by the administrator can be taken to court where a probate judge will have the last word as to whether or not the case stands.

Estate Planning Attorney Fundamentals Explained

After the stock of the estate has actually been taken, the value of possessions computed, and taxes and debt paid off, the executor will after that seek permission from the court to disperse whatever is left of the estate to the recipients. Any kind of estate taxes that are pending will come due within 9 months of the day of death.

Each private areas their properties in the trust and names somebody apart from their spouse as the beneficiary. However, A-B trust funds have actually become less prominent as the inheritance tax find more information exemption functions well for many estates. Grandparents may transfer properties to an entity, such as see it here a 529 plan, to sustain grandchildrens' education.

Some Known Details About Estate Planning Attorney

This method involves freezing the worth of a property at its worth on the date of transfer. Accordingly, the quantity of potential resources gain at death is likewise iced up, permitting the estate coordinator to approximate their potential tax obligation upon death and far better prepare for the repayment of income tax obligations.

If enough insurance policy profits are readily available and the plans are correctly structured, any earnings tax obligation on the regarded dispositions of assets adhering to the death of a person can be paid without considering the sale of assets. Proceeds from life insurance policy that are gotten by the recipients upon the fatality of the insured are generally earnings tax-free.

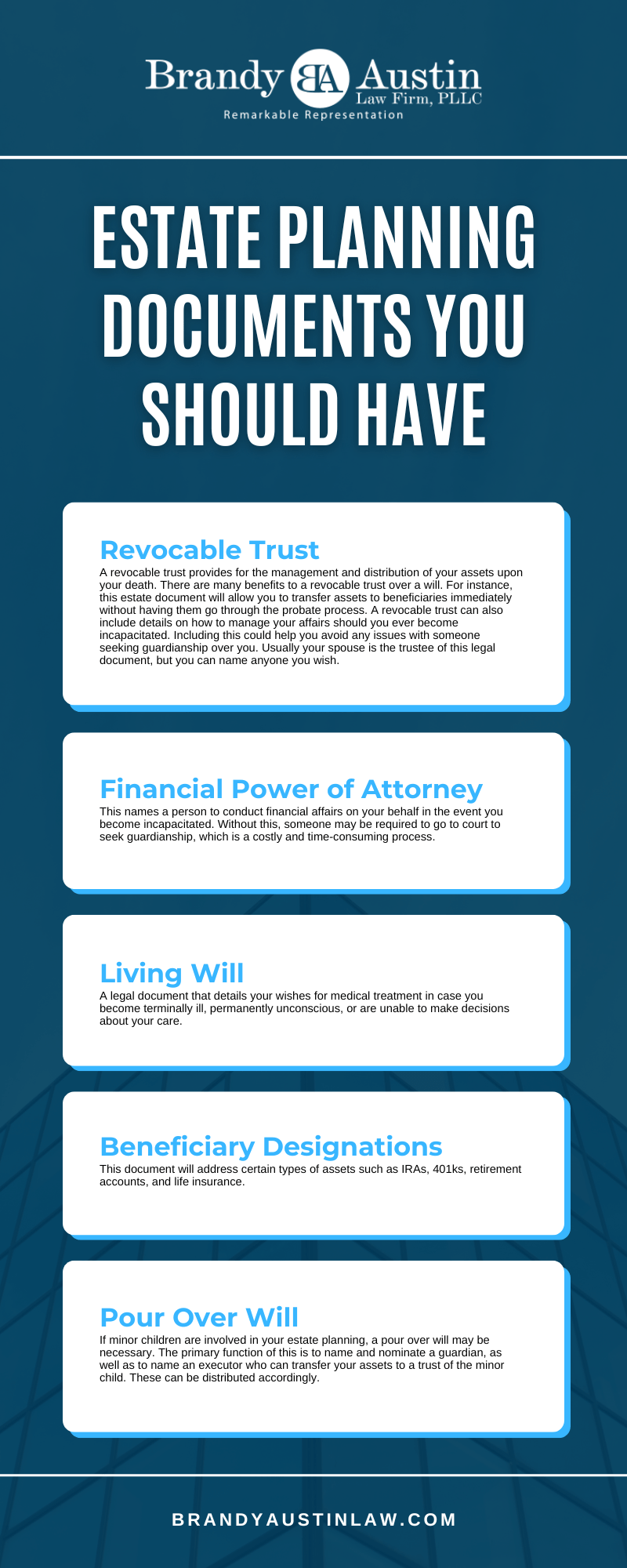

There are specific papers you'll need as component of the estate planning procedure. Some of the most typical ones include wills, powers of attorney (POAs), guardianship designations, and living wills.

There is a myth that estate planning is only for high-net-worth individuals. Estate planning makes it easier for people to identify their desires before and after they die.

Rumored Buzz on Estate Planning Attorney

You must begin preparing for your estate as soon as you have any quantifiable possession base. It's a continuous procedure: as life proceeds, your estate plan ought to shift to match your conditions, in line with your brand-new goals.

Estate planning is often believed of as a tool for the rich. Estate preparation is likewise a terrific means for you to lay out plans for the care of your small children and pet dogs click here to read and to outline your desires for your funeral and favorite charities.

Eligible candidates that pass the test will be officially accredited in August. If you're qualified to rest for the examination from a previous application, you might submit the brief application.

Report this page